Hazini supports the

financial wellbeing

of employees

financial wellbeing

of employees

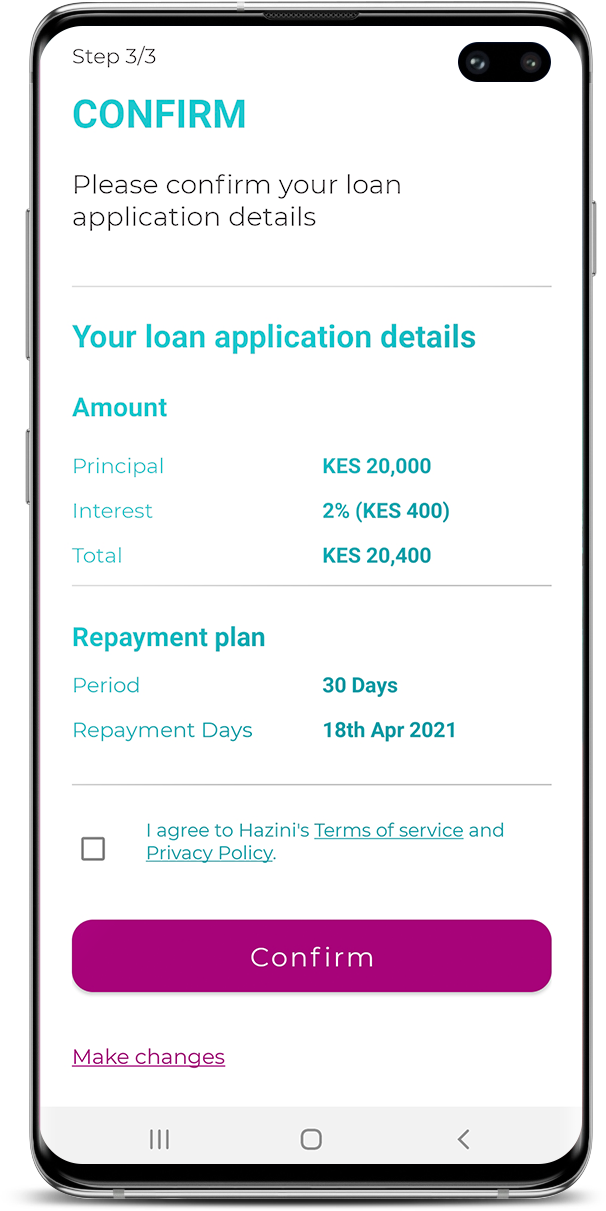

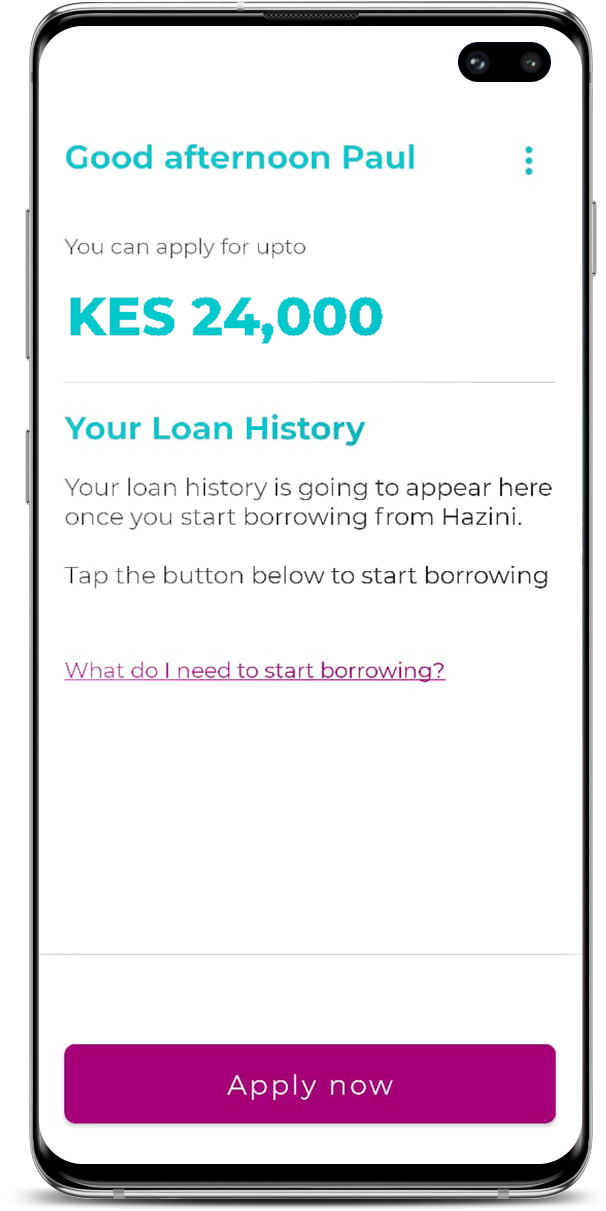

Using the Hazini salary advance, your staff can access advances of up to Ksh 200,000

Why Hazini is unique

Effortless repayment

Your employees don’t have to remember to repay. Everything is setup for them and repayment is processed automatically. Truly effortless.

EMPLOYER

Employer checks on due installment, deducts from salary before processing salary payment and uploads deduction list to automatically reflect on the app as loan paid.

EMPLOYEE

Employee chooses to repay directly via app or the due amount is deducted from salary.

Salary advance of up to

70%

70%

Sometimes the working nation need a little helping hand to make it through the month.

Hazini helps employees avoid unfair interest, fees and Hidden charges and gives them early access to their pay anytime anywhere.

Find out more

Key benefits

Avoid unfair interest

Hazini is a better alternative to expensive forms of short term credit.

Effortless repayment

Hazini automatically recover any money owed directly from your employees’ next pay

Secure

Hazini is secured by industry-grade highest standards. Your data is in safe hands.

No impact on credit score

Hazini doesn’t affect your employees’ credit score or history.

Private and secure

Hazini doesn’t sell or share data so it’s safe and secure with us.

Here to help

Support is available directly on the app via chat, web form or phone.

Employee

stories

stories

I’ve had bad experiences with pay day loans in the past so being able to access Hazini really is a blessing to me, especially since it doesn’t affect my CRB status either.”

Cynthia, Vaspro Limited

Before Hazini I would use my assets like my Logbook and Title deeds to get loans, after I started using Hazini, I have peace of mind and I know my assets are safe and secure all thanks to Hazini’s quick instant loans.”

Johnstone, Califam Holdings

Hazini is my go to app for the little emergencies of life, a while back, my son was unwell and I needed some quick cash to clear his hospital bill, I was so stressed and anxious but after I contacted my HR and he referred me to HAZINI, I have never looked back.”

Marjorie, Southwell Solutions